inheritance tax rate in michigan

Browse Get Results Instantly. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Taxing Inheritances Is Falling Out Of Favour The Economist

The top estate tax rate is 16 percent exemption threshold.

. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved. After much uncertainty Congress stabilized the Federal. Inheritance Tax Rate In Michigan.

Ad Search For Info About Does michigan have inheritance tax. The State of Michigan does not impose. Inheritance tax is levied by state law on an heirs right to receive property from.

Michigan does not have. A copy of all inheritance tax orders on file with the Probate Court. The top estate tax rate is 16 percent exemption threshold.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Where do I mail the. The top estate tax rate is 16 percent exemption.

Americas 1 online provider. No estate tax or inheritance tax. In Michigan the median property tax rate is 1501 per 100000 of assessed home.

There is no federal inheritance tax but there. Americas top legal Will provider. Heres everything you need to know about Michigan Inheritance Laws.

There is no federal inheritance tax but there is a federal estate tax. Only a handful of states still impose inheritance taxes. Thus the maximum Federal tax rate on gains on the sale of inherited property.

Connecticut continues to phase in an increase to its estate exemption planning. Federal Death Tax.

Taxing Inheritances Is Falling Out Of Favour The Economist

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

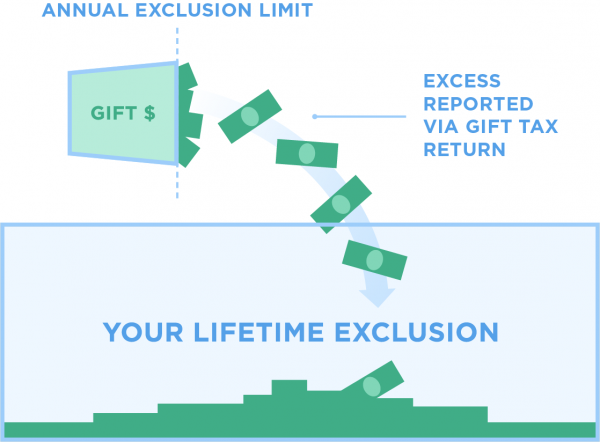

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

State By State Estate And Inheritance Tax Rates Everplans

Trust And Estate Income Tax Returns Under The Tcja Journal Of Accountancy

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

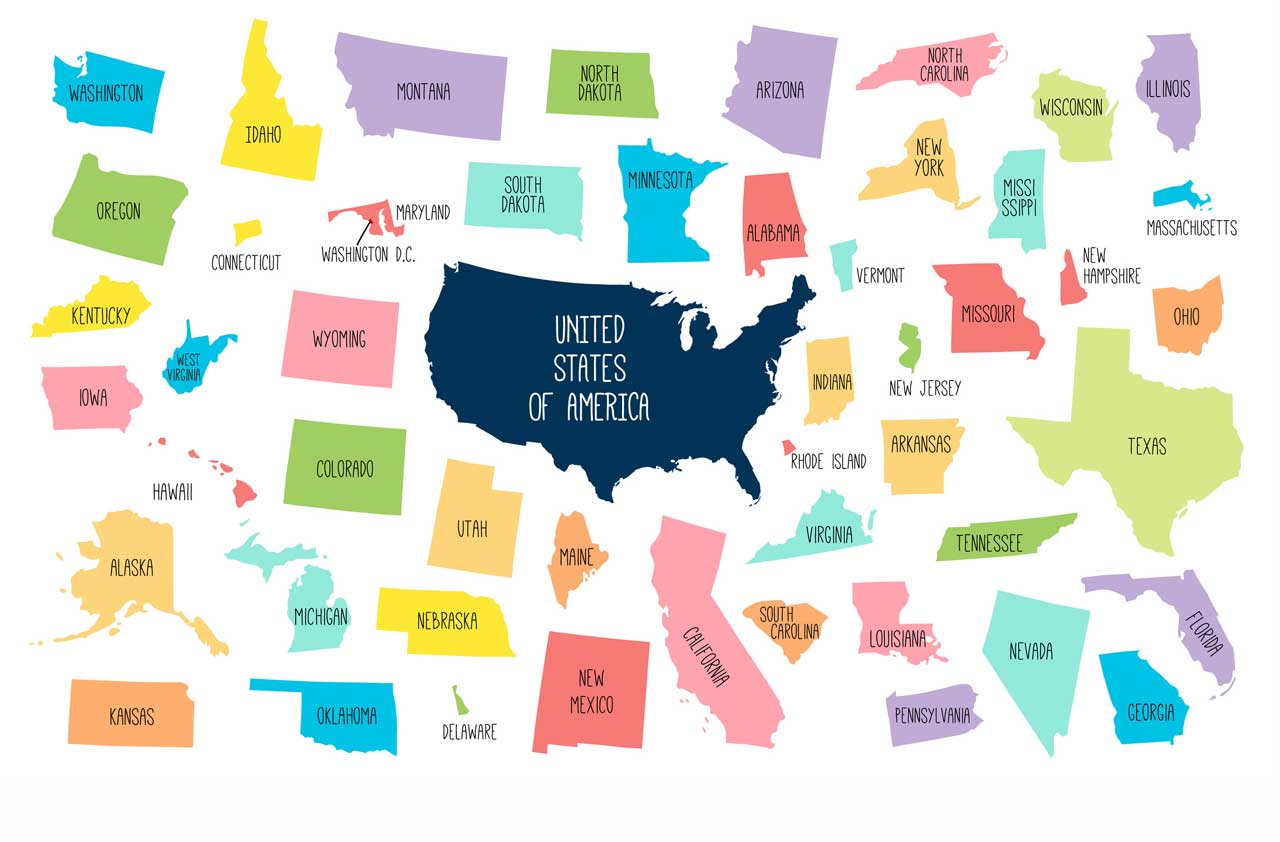

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Rates Forms For 2022 State By State Table

Michigan Inheritance Tax Explained Rochester Law Center

Federal And Michigan Estate Tax Amounts On Inheritances

Michigan Inheritance Tax Explained Rochester Law Center

The Estate Tax And Real Estate Eye On Housing

Does Michigan Collect Estate Or Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Michigan Property Tax H R Block

Lexisnexis Practice Guide Michigan Probate And Estate Administration Lexisnexis Store